On Monetary Populism and Central Banks / Bill Emmott

In their ideal world, central bankers want to be thought of as boring. For them, less attention is better than more attention. They prefer to be seen as technicians, operating and maintaining the financial machinery of a country, rather like plumbers or engineers, rather than celebrities or power-holders. That view that boring is better lay behind the fashion over the past 20 years or so of making central banks legally independent of government, so as to protect the plumbers from political interference. But politics finds interference irresistible, and the fashion of leaving central banks alone is changing. <August、2019>

After all, as a famous American bank robber Willie Sutton once said, “that’s where the money is”. Right now, more and more politicians are desperate to get their hands on that money, all over the world, by regaining control over central banks. Although their motives are populist in nature, they are not entirely wrong in thinking that central banks could potentially be put to more use than in the past, given today’s economic and financial conditions. Nevertheless, this trend is likely to bring its own negative consequences. For it has already done so in Japan.

Donald Trump, not surprisingly, is in the forefront of this populist push: in July and August, as evidence mounted that America’s economic growth is slowing down, he hurled pressure on America’s central bank, the Federal Reserve, to cut interest rates and create more money. On August 14th, for example, he tweeted:

“Spread is way too much as other countries say THANK YOU to clueless Jay Powell and the Federal Reserve. Germany, and many others, are playing the game! CRAZY INVERTED YIELD CURVE! We should easily be reaping big Rewards & Gains, but the Fed is holding us back. We will Win!"

We should note, indeed, that Jerome (‘Jay’) Powell was President Trump’s own appointment as chairman of the Fed, after Trump chose not to reappoint his predecessor, Janet Yellen, at the end of her first term in office in 2018. Despite making that appointment, President Trump is getting more and more frustrated that he cannot control the central bank directly.

A similar desire has taken hold among populist, anti-establishment politicians on the left as well. In my country, Britain, the opposition Labour Party has floated the idea of “people’s quantitative easing”, by which it means having the central bank create money for direct distribution in payments to ordinary people in order to boost their incomes and promote consumption, or for spending on public purposes such as infrastructure or education.

This notion reflects what has become known in the United States as “Modern Monetary Theory”, abbreviated commonly to MMT, which has been popularised by Stephanie Kelton, a former economic advisor to Senator Bernie Sanders, the left-wing Democrat presidential candidate, and even more so by the rising young Democratic star in Congress, Alexandra Ocasio-Cortez. Put simply, MMT holds that governments can never run out of money and should not be overly constrained by budget deficits, as they can always have their central banks just create more money.

Meanwhile in Italy, this notion is catching on among anti-establishment parties both on the left and the right. As some readers may know, as well as Japan, the other country which I try to study closely is Italy. There are many reasons for this, including the culture, food and wine, but prominent among my reasons have been the similarities between the two countries’ long economic and even political declines, since the early 1990s. Both have declining and severely ageing populations, both have labour markets sharply divided between regular workers on permanent contracts and non-regular workers on short-term and part-time contracts, and both have very large government debts.

Italy’s economy has been performing a lot less well than Japan’s over the past decade. It is the only big western economy that still has a smaller GDP than it had in 2008, and real household incomes are stuck at the same level as 20 years ago. As a result, disillusionment with the old-established political parties has risen and new, more populist and nationalist parties have grown in strength. For the past year, in fact, Italy’s government has been a coalition between two such political parties which both had strong support in the 2018 general election: the fairly left wing Five Star Movement and the quite right-wing League, which was originally a separatist party representing only the north of the country but is now seeking national support.

Both of these parties have expressed frustration at the constraints imposed upon Italy by their country’s membership of the European single currency, the euro, which means that monetary policy is controlled by the European Central Bank and not the Bank of Italy, and fiscal policy is subject to common euro zone rules. Consequently some leading figures in both parties favour taking Italy out of the euro. In preparation for such a move, in fact, draft laws were tabled this summer at the Italian Parliament to increase the government’s control over the Bank of Italy.

This is not yet official policy in either political party. But we should note that in Britain too, the idea of leaving the European Union began in the minds of an influential minority in the governing Conservative Party in the 1990s. Then, many years later, Britain voted in a referendum in 2016 to leave the EU. So it is possible that in Italy too, this idea is just beginning, and might grow into something more dramatic. And let us note another interesting feature: when I visit Italy and talk to politicians and economists about the country’s debt and its economic dilemmas, more and more of them mention Japan.

This kind of treatment of central banks is quite normal in developing countries. We have come to expect politicians in countries like Venezuela, Argentina or Turkey to interfere in central banking, and the result is usually financial chaos. But we don’t expect it in richer, developed countries.

So why is this happening? Why are more politicians again seeking to control “where the money is”, at central banks, and so are contradicting the previous orthodoxy of central bank independence? There is a technical and economic answer. And then, as my Italian friends have indicated, there is the encouraging example of Japan.

The technical and economic answer is that since the 2008 Lehman Shock and global financial crisis, two big things have happened in western, developed countries. One is that countries have built up very large public debts, which for most countries are the largest as a proportion of GDP that have been seen since the second world war. The US gross federal debt totalled 106% of GDP in 2018; France’s was 98.5%; Italy’s was 132%; Britain’s was 87.4%. These are all small compared with Japan’s gross public debt of 250%, but are far larger than in the past: in most cases, double the typical level seen between 1960 and 2008. This mountain of sovereign debt is believed to place limits on what countries can do directly with more public spending and borrowing so as to meet political goals, which makes it tempting to use central banks and monetary policy instead.

The second big development is the absence of inflation. It was the need to keep control over inflation, and to convince companies and investors that price stability would be maintained, come what may, that led countries in the 1990s to make their central banks independent of government control. America never did so formally, but informally the White House agreed to refrain from commenting or interfering with the Federal Reserve.

In the now 10 years of economic recovery from the post-Lehman Shock recession, policy makers and politicians have constantly assumed that once unemployment falls back to pre-2008 levels wages will start to rise and so inflation will become a problem again. That is why the Federal Reserve began to raise interest rates in 2015 and so tighten monetary policy in anticipation of rising pressures from inflation. Yet so far, inflationary pressure has been modest at best, both in the United States and in Europe.

Perhaps it is just a matter of time. Rather as in Japan after the bursting of the bubble economy in 1990, the trauma of the financial crash of 2008 has been much greater than in previous recessions. The recovery in employment in the US and Europe has included a lot of low-skilled, low wage jobs, many of them part time and on short-term contracts. And this recovery has coincided with a period of technological innovation, chiefly of digital information technology but also involving artificial intelligence, which may be depressing wages for low and middle-skilled employees.

With the fear of inflation much less politically important than before, but with budgetary policy still controversial and constrained by debt and by financial markets, the case for central bank independence looks a lot less powerful than it did in the 1980s and 1990s. Which is why many influential people are now watching Japan once again. For Japan has been the global pioneer of populist interference with central bank independence.

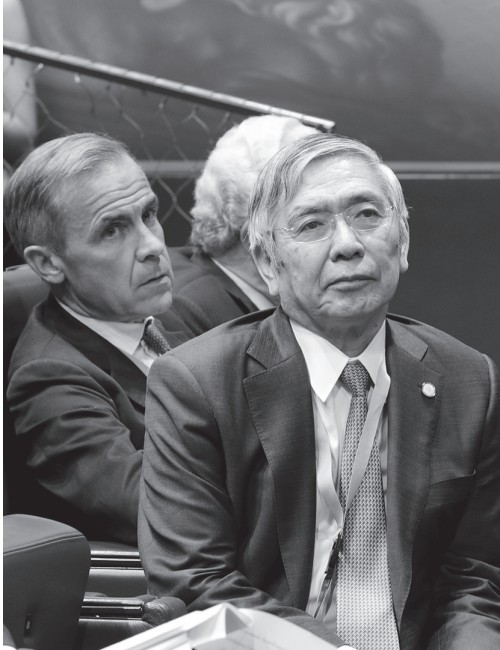

It has been nearly three decades since Japan was last watched closely by the rest of the developed world for lessons in how to manage its economy, apart from some periods during the banking crisis when the world looked for lessons in what not to do. But now the view is spreading that Japan has been conducting a fascinating laboratory-style experiment in economic policy. The chief scientist of this laboratory experiment is the governor of the Bank of Japan, Haruhiko Kuroda. But his controller, of course, has been the prime minister, Shinzo Abe and his government.

What happened in 2013 when Mr Kuroda was appointed in place of his more conservative predecessor, Masaaki Shirakawa, is well known in Japan, but less well known at least in its specifics in the rest of the world. What most westerners know is that Mr Kuroda declared a goal of ending deflation and achieving a 2% inflation rate, and to do so greatly expanded the Bank’s programme of quantitative easing by buying up huge quantities first of government bonds and then other securities, including equities.

What European and American populists have taken note of is not the details of Governor Kuroda’s monetary policy, nor even the fact that it has so far failed to achieve its declared objective of creating a stable level of price inflation of 2% per year. What they have taken note of is the fact that Kurodanomics have meant that Japan’s 250% of GDP public debt no longer seems to matter.

The huge public debt no longer matters because most of it is now financed directly by the central bank. In the past, Europeans who looked enviously at Japan’s public debt convinced themselves that Japan was different to European countries because virtually all of that debt was owed domestically, in other words unlike in Europe it did not depend on fickle foreign investors. Now, that difference is less crucial: the big change is that the BoJ accounts for half of the Japanese Government Bond market. Its purchases are therefore simply financing public spending and borrowing directly. If it were to decide to, it could simply cancel vast amounts of public debt.

Essentially, Abenomics has, over the past six years, really been Kurodanomics. What the BoJ’s huge monetary expansion has meant is that the Abe administration has been able to avoid a lot of hard choices in structural reform of the economy, fiscal consolidation or direct intervention to increase wage rates.

European and American populists would love to be able to do the same. To them, Japan has proved that in a non-inflationary era it is possible for the central bank simply to create money for the politicians to spend.

What the rest of us should note, however, is that this achievement by the Bank of Japan has come at two big costs: first, that prices for all sorts of securities, including equities, are distorted by this use of public funds; and second, that deeper reforms have as a result been postponed, yet again.

Populist control of central banks certainly buys an easier life for the politicians, as it has done for Prime Minister Abe. But whether it can ever bring long-term prosperity remains to be seen. Certainly, it has not done so in Japan.■